Virtual Product Development, the key of innovation

In November 2005, I attended the Chinese user conference of MSC.Software, the largest CAE and VPD solution provider worldwide. I was honored to interview Mr. Frank Kovacs, the Strategic Alliances VP of MSC.Software, Mr. Christopher St. John, the AP Operations SVP of MSC.Software, and Jason Li, the general manager of great China. We talked about the global application trend of CAE and VPD, and the product family of MSC.Software, and the partnership of MSC.Software, etc.

Pei Huang: Which industry sectors contribute most of your customers?

Frank Kovacs: From the company prospective, the majority revenue of MSC.Software is coming from Automotive, Aerospace, heavy industry and two new developed market-one electrical mechanical, and second is biomedical engineering, which is the balances coming from. In fact, there are also many customers distributed in national defense, machinery, weapon, shipbuilding, railway, civil engineering, electronics, petrochemical, energy, electricity, research institutes and universities, and so on.

Pei: Please analyze the status and developing trend of global CAE and PLM market.

Frank: We believe very strongly that a fluctuant point coming in the global CAE market. The growing speed of CAD market is declining, and the growth of PLM market almost flat, so, the high rate of the PLM industry actually comes from CAE, and you can this many ways. You can see it in investment that companies make by CAD companies of buying CAE technology and embedding it. We will see a flip where there will be more money spent on CAE than spent on CAD. The aggregate growth of dominate PLM player is 5~8%, but some of these companies lost money on CAD business. Relatively speaking, digital simulation is 2 billion dollars industry with the growth rate 12%, and we focus on component FEA and system performance, which are growing very fast.

Pei: How could CAE benefit the manufacturing enterprises? Please introduce the product strategy of MSC.Software.

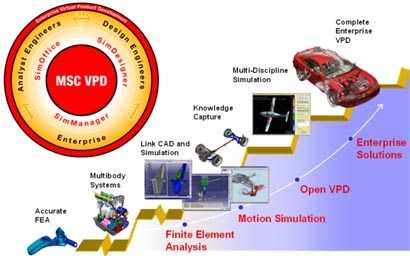

Frank: In one word, it would be Innovation. CAE is the technology to help drive innovation. If I am a CEO, I care more about my next product, and my next product being a leading product in the market, so, CAE is really the technology that helps drive the innovation. MSC.Software provide very large group of CAE technologies, the first one is around strategy of SimDesigner. Now, we see more use of the CAE technology for designers than we have ever seen before. Many of the changes in the technology are to put the technology at the hand of the designer. He is not the Ph.D, he is not sophisticated, he is very much CAD centric, and he doesn't want to become a CAE Ph.D. He only wants to apply it to design. The second CAE technology strategy we offer is SimOffice. The SimOffice user has to have access to many different kinds of technologies. He might take the product design and apply to a durability test. He probably is also doing some other types of studies. The third CAE technology strategy we have is MSC.SimManager. SimOffice users could create the process template, and put the template into the library of MSC.SimManager, and then be checked out and utilized by SimDesigner users. By this way, we can get more consistency, and we can get more users doing more CAE sooner, and that will drive product innovation in the manufacturing enterprises. So, we are tying to group our broad product portfolio into SimOffice, SimDesigner, and MSC.SimManager. For our customers, it is very logical as it is followed by organization of designers and pure engineers. We are trying to deliver the platform of VPD to meet each customer's configuration, for example, to configure the VPD platform of aerospace and automotive. But the functions are very similar for sophisticated engineers. For the manufacturers, such as Boeing and Chrysler, their simulation problems are no longer very specific and discrete problems, so we will continue to add application functions into our product to meet the requirements of different users.

Pei: Are there any standard classification of CAE technologies?

Christopher St. John: Most of the time, the requirements of the customers are for multi-discipline and multi-simulation capabilities. For example, if you are doing a durability assessment, you should analysis the durability of a component within the system. The system today is modeled as a multi-body, dynamic system, so that it drives detailed analysis. We can do different levels of simulation. So, the practical classification of CAE is structural simulation, thermal simulation, motions simulation, flow dynamic simulation, and manufacturing simulation, and these simulation require technologies in different areas, and they move forward to a true system level of simulation. We expect all that technology could be used together. For example, you can't make a fully functional digital car without motion simulation, structural simulation and thermal simulation. Now, more and more car is electronic today, so, you can't make it without electronic magnetic simulation. We want to put all those things together and that is where MSC.Software is going.

Pei: How many percent of CAE technologies could MSC.Software provide? How could MSC.Software. Software Corporation innovate continuously?

Frank: The strategy of MSC.Software has changed in the recent years. Previously, MSC.Software developed through acquisitions strategies, attempted to build the capabilities in all areas, for all people and for everything. If we didn't know how to do it, we went to get the experts and bought the company. I call this strategy inorganic growth. Today, our corporate strategy is to focus on the core competence of the company, focus on the things we do best, which we do better than anybody else, and extend those capabilities. We partner strategically with the leaders in the market to complement that technology. One of the largest undertakings in software development inside MSC.Software today is around the VPD platform to ensure that our technologies are delivered by components on the platform. We have announced the partnership with CD ADAPCO and ENGINEOUS, both are leaders in their areas. In the future, we will bring these technologies together even tighter going forward, so that we can deliver them to our customer with single experience. There are still some areas which simulation tools are still needed for discrete component, but the simulation for system is the end game. It's about the systems, and not about the parts, not about the components. So we have to keep our eyes on getting into the system solution but not lose the side of the level of technology we deliver. As far as the evolution of MSC.Software, our focus is really around the platform and delivering of that vision of platform. We are delivering our core competency covering 80% of what the customer requires and partnering to meet the rest requirements, so that we can meet more than 80% of customer needs. But in the primary industry that we serve, we want to be a core technology provider for the customer, for the bill of analysis.

Fig.1 MSC.Software.Software Roadmap

Christopher: My view is similar. The objective platform which we provide is a very comprehensive solution to the areas, which are our core areas, and for core customers. I want to add an aspect to the platform, which Frank did not mention. It will provide the framework within which other companies can embed their solutions. So, there are other companies that they have to plug in to the framework, which allows users to get access very broad set of technology on the environment which MSC.Software provides. So I see two trends with our partnership strategy. One trend is that we will cooperate with our partners extremely closely to highly integrate the technology and to make it possible to deliver the vision of fully functional digital prototypes with system level models and create all the physic prototypes just necessary to do the real hard work. Another trend is that it could be other plugging which enrich the technology and allow other organizations to bring their technology alongside with the core technology we offer.

From the point of view of the presentation of the different types of simulations, I think you will see everything inside MSC.Software. That doesn't mean that we could provide 100% solutions and 100% of what the people want to use the simulations. So, I agree that we can provide 80% of CAE technology.

Pei: Please explain the difference of DMU, CAE and VPD (Virtual Product Development).

Christopher: DMU (Digital Mockup) is about creating digital representation and basically the geometry and the assembly of a product, tells you how it put together. It can tell you whether a part clash when they move, but it tells you nothing about functionality. For example, Digital Mockup will tell you if you have a car with a door, but they will not tell you the experience of how to use it and how it works. You will just know it fits in the hole, and can open and close. However, door is your first experience of a car; many people judge the quality of a car by the door. DMU will not tell you the quality of the door, and the quality the user experience the door, but VPD will. VPD will tell you exactly how the things work, and how the user experience could be.

Frank: DMU was trying to create a simple primitive that was accurate enough to get the description of complicated product. In those days, it was impossible to model an entire car, because just to shade it took an hour. People had to create a simpler representation so that the parts can be fit together. Now, VPD could get the system level understanding of the product. From 5 years ago, we started to use the words "Virtual Prototype", and then we changed to "Virtual Product", which is about the whole product. So, now we focus on Virtual Product Development. So, in short, DMU is the general fit of a product; VPD is a comprehensive view of product; CAE is specific to a sub-system area or problem.

Pei: What are the key factors to win in the global CAE market, the technology, consulting experience, integration, industry solution, or the others?

Frank: If you look at the foundation of these technologies, they are built on very strong knowledge of engineering and applied sciences. The difference that I see significantly and the reason that I came to MSC.Software is this company understand how the technology is applied better than any one.

Traditionally, CAE is directly based on PDM/PLM platform. It interacts with PDM/PLM software to evaluate the design result. When there are some problems, it will lead the dimension change or redesign and re-submit. So, this is really a CAD centric, model centric new product developing process. It is different that VPD is used in requirement stage, design stage, and used to simulate the whole system. For example, in requirement stage, VPD can be used to do some validation on specifications, on some sourcing data, but specific on function, and to find some materials which can survive in the heat requirement.

We have inserted a layer of technology between CAE technologies and PLM system, and it is MSC.SimManager. VPD manages the Bill of Analysis. It contains the information of where to get the data, what simulation work is done, and this information can be built into a template. When the next design comes through, the user can reuse it.

MSC.Software has very deep understanding with how the CAE technology is applied, and the process where and why the specific CAE technology is applied. We have very good experience to use different solvers, different technologies to simulate systems. We can work with different partners and come with solution that is very strong for different industries. These are the key factors for us to win in the global CAE market.

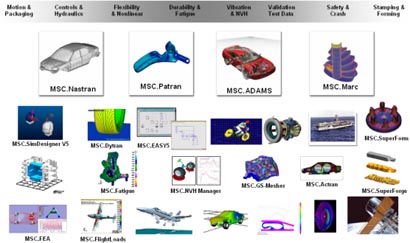

Fig.2 Product family of MSC. Software

Pei: Please introduce the product family of MSC.Software.

Christopher: We really have a very large product family. Our core technologies include MSC.Nastran, MSC.Patran, MSC.ADMAS and MSC.Marc. MSC.Nastran is used for structural analysis, and MSC.Patran is for modeling environment, the general purpose environment. MSC.ADMAS is used for motion, multi-body dynamics, and MSC.Marc is for non-linear simulation. We have great majority of portfolio, such as MSC.Dytran, MSC.EASY5, MSC.Fatigue, etc. These are the general purpose tools. Then, we have many industry specific applications. For example we have product like MSC.FlightLoads and MSC.SuperModel, which is targeting aerospace industry. They build on the basic MSC.Patran functionality.

MSC.Software is continuing to invest to expand our core products, what we call enterprise and platform products, which is now including MSC.Nastran, MSC.Patran, MSC.ADMAS, MSC.Marc, MSC.Dytran, and MSC.EASY5 control systems, and MSC.SOFY, the modeling system which is most specific for automotive industry. In many cases, we build industry specific applications on top of these core products. You can find several applications based on MSC.Patran, and applications based on MSC.ADMAS, such as MSC.ADMAS/Car, MSC.ADMAS/Rail, and MSC.ADMAS/Aircraft. So, our core technology will continue to enrich, and around that we build VPD solutions framework based on?? SimOffice, SimDesigner, and MSC.SimManager.

What our customer depends on today is enterprise platform. Everyday they are using MSC.Nastran, MSC.Patran, MSC.Dytran, MSC.ADMAS or MSC.Marc, but they also take full advantage of our new platform, which will support the functionality in new and more efficient way.

Pei: How did MSC.Software Corporation grow in the recent years?

Frank: MSC.Software may be actually the fastest growing company in the CAE industry and continue to grow significantly. We have brought on five new senior executives. We are continuing to grow both the sales organization, and product development organization. One of the interesting changes of MSC.Software is that we have doubling the number of people in product development to create VPD platform and deliver to our customers the promise of VPD, and it is very significant to do that.

Pei: Are there any overlap between different MSC.Software softwares? Can they integrate to each other well?

Christopher: The answer is Yes and No. There are many overlaps, and there are many overlap in the structural area. There is significant overlap between MSC.Nastran and MSC.Marc, for example, partly because the acquisition of MSC.Software. That is why the main emphasis of our activity over the past two or three years is integration. We want to eliminate the overlap, and bring the technologies into a common framework, so that different technologies can be seamlessly integrated. That is our direction.

Frank: MSC.Software acquired many companies in the past. It was strategy of inorganic growth. A company can grow by acquiring everything, but the trouble of the acquisition is to rationalize the people and the technology. It is a hard decision, because our customers love MSC.ADMAS and MSC.Nastran. For years, MSC.Software continues to stand MSC.ADMAS, MSC.Nastran and MSC.Dytran, and overlap gets worse. Recently, one of our new executive, Glenn Wienkoop, our president and COO, who was previously president and COO of SDRC, spent time to look at the development technologies and decided to focus on the VPD platform. The new strategy he put forward is to partner with the companies, judge the strategic fit with the VPD platform, and then we will look at acquisition. It is combination strategy of indoor development and acquisition, instead of growing the business through acquisitions. Glenn is very strong at architecture, strategy and product development. I think you will find some very nice technology coming forward very quickly. Another important shift of MSC.Software is from technology driven to market and customer driven. The acquisition and the deliver of technology are around what the customer needs, and how to deliver the VPD to the customer to be successful.

Pei: What's your view about Dassault Systèmes acquiring ABAQUS?

Frank: We have strategic relationship with Dassault. They depend on us to deliver SIM Designer technology to the customers. We will continue deliver SIM Designer to their CAD users, but we will grow the community to more than just CATIA customers. The acquisition of ABAQUS for Dassault brings them some non-linear capabilities. However, Dassault has announced that they have to take more time to actually deliver an integration solution.

Our role with the Dassault today is to provide CAD users and engineers with a suite of technology that would help them to be better engineers. I agree that this acquisition is an opportunity for Dassault Systèmes to bring CAE in their total solution. We still have many situations where we work side by side with Dassault Systèmes on SimDesigner technology.

We are the No. 1 in MSC.Nastran, No. 1 in MSC.ADMAS, No.1 with modeling in MSC.Patran, and No. 2 with MSC.Marc, which we do not feel so good. We don't stop developing non-linear capabilities. You will see more and more capabilities in this area come from MSC.Software. But our goal is not to compete with Dassault Systèmes PLM vision. Our goal is to deliver expert VPD technology and plug that into Teamcenter or Enovia PLM, or whatever the environment is. Our focus is around VPD and that's where we are going. The strategy of SIMULIA is focus on the CAD, and everything is driven from CATIA system. This is not truly the way we think to go after true system level performance.

They made the announcement to acquire ABAQUS after the AIRBUS, which is CATIA customer, made the strategic decision of using MSC.Software. They made the decision to come with us. The impact for us is not significant.

Pei: Do you have some solutions for SMB market?

Christopher: We have about 10,000 customers. Among that there are many small companies who also use simulation technology, so, SMB market is important to us and it is a significant part of our business. A good example would be in Japan. There are many small manufacturing companies, who are making extensively use of our technologies such as MSC.Marc to support the development and validation of product. And moving forward, SimDesigner provides simulation capability inside CAD systems, and that maybe is a big company vision. We need also to deliver simulation in easily used form to small organizations. They haven't built up large VPD infrastructure, but they still need tools in order to support their development.

Frank: There are very large needs for simulation technologies coming from SMB customers. The change in automotive OEMs is that they now push the engineering and warranty support down to the suppliers. This change is resulting in a requirement for them to be able to do this kind of test and analysis. The request will be getting from small companies. It is not for small functionality, they want to get their hands by the same functionality. They just want to run in Windows platform and they want to run it in a low cost way. Previously, these smaller companies would have low cost, cheap CAE solutions, such as COSMOS and ALGOR. These are just designed for components and parts, no systems, no sophisticated, no non-linear analysis. Their requirement is changing because their customer is telling him that they must do these things. So, it is a big change in automotive industry. The driving force of the middle market for us is that the request of the customers is changing, what they ask for is different.

Christopher: As we move forward, large cooperation will increasingly expect more from supply chain. They will also integrate VPD process with the supply chain. We expect these suppliers use our tools and platforms together with their OEMs.

Pei: You announced two new partnerships on this user conference with Engineous and CD Adapco. Please introduce the cooperation content and benefit.

Frank: Our partnership with Engineous will further benefit customers by delivering a robust, seamless solution today to our customers. MSC.Software and Engineous technologies will be combined to provide customers with managed product development for VPD solutions ranging from specific engineering tasks to large scale inter-company engineering processes. Engineous' iSIGHT process integration and design optimization software and FIPER, a component-based, integration infrastructure will enable significant design improvements using our enterprise solutions. This alliance will couple MSC.Nastran, MSC.ADMAS, MSC.Patran, MSC.Marc, and MSC.Software stochastic simulation technologies with iSIGHT and FIPER. The combined functionality can be managed by SIM Manager. So, our strategy is really to do more simulation, faster, and more efficient, and get better user experience.

We choose the alliance partner very carefully. There are other options for us, but the technology and corporate culture of Engineous and MSC.Software is fit very well. Engineous is the leader in their area and I believe that CD Adapco from technology prospective is very strong. I think we will have some very powerful capabilities here. After integrating Engineous solutions, MSC.SimManager could manage the multi run simulation process automatically.

We have cooperated with CD Adapco in automotive and aerospace industry. It is already a good alliance and we will make it much better.

We have also built some strategic alliance with our large customers. The goal is to engage our key customers globally about their business issues, the market issues. The technology is only an enabler to solve the business problem. If we build a partnership, the result happens much faster, and is much more effective. And we can share the best practice with other customers faster. This is how we sustain competitive advantage, how we stand in the competition.

Pei: Please analyze the trend and the benefit of VPD application.

Christopher: I'm sure that VPD will be the heart of new product development. This will be a revolution that full functional digital prototype will be used to collaborate and communicate within the organization and across the supply chain. It will challenge the organization structure and even the trade unions. The CAE technologies will evolve quickly to ensure this revolution in the way of new product development. It will particularly change the way of doing business in old industries. I think that the revolution will happen in China quicker than in other developed countries, because China is just begin to use simulation, so you can build a new types of development organization very quickly, and you needn't to replace the old development structure. For example, many Chinese automotive manufacturers improve very aggressively, and they build their new product development ability directly on VPD platforms.

Frank: Now, there is vice president of VPD in many giant manufacturers, such as Boeing, Chrysler. More and more world class manufacturers have adopted VPD platform, for example BMW, Nokia, etc. Now, we have already offered the service to evaluate their VPD mature model for our customers. More and more manufacturers use virtual product test to reduce the physical test, they don't build many physical prototype any more. The VPD application has greatly cut down the time to market of the new product.

Christopher: The calculation ability of VPD improves very quickly. We can simulate a virtual car driving on a virtual road, and a virtual plain fly in the air. With high performance of computing technology, we can solve increasingly complicated problems. Three years ago, we could solve 100,000 degrees of freedom problems, but now, we could solve 10M and even 100M degrees of freedom. We have already done system level simulation for a whole product, and we can also simulate the components of the product in great detail. The simulation of the whole product and the components will just use the single model. We are now offering the technology of real time simulation in the product MSC.ADMAS/Real.

Pei: How did MSC.Software grow in China in 2005?

Jason Li: Our revenue in China is more than $10 Million last year. Of course, MSC.Software is the No.1 in the Chinese CAE field, and we had wonderful performance. Now, we have four offices, an engineering consulting center, a global R&D center and nearly 70 employees in China. We have 15 training centers around China. Our customers widely spread in aerospace, automotive, machinery, electronics and education agencies. In 2005, we got many important successful cases, such as Shanghai Auto Industry Group, FAW-Volkswagen, Changan Auto, the First Aviation Research Institute, etc.

Picture of Pei Huang (Middle) with Frank(Left)and Christopher (Right)