Salesforce.com Announces Fiscal Third Quarter Results

Salesforce.com announced results for its fiscal third quarter ended October 31, 2009.

First Enterprise Cloud Computing Company to Exceed $1.3 Billion Annual Revenue Run Rate

Record Revenue of Approximately $331 Million, up 20% Year-Over-Year

GAAP EPS of $0.16, up 100% Year-Over-Year

Operating Cash Flow of $36M, up 107% Year-Over-Year

Record 4,700 Net New Customers During the Quarter

Total Customers at 67,900, up 31% Year-Over-Year

Total Cash and Marketable Securities of $1.07 Billion, up $265 Million Year-Over-Year

Company Raising Full Year Revenue Guidance to Approximately $1.29 Billion

Company Raising Full Year GAAP EPS Guidance to Approximately $0.62 to $0.63

SAN FRANCISCO, Calif. – November 17, 2009 – Salesforce.com (NYSE: CRM), the enterprise cloud computing company, today announced results for its fiscal third quarter ended October 31, 2009.

“We are pleased to report record revenue, profit, and customer additions in Q3,” said Marc Benioff, chairman and CEO, salesforce.com. “This gives us fantastic momentum as we head into Dreamforce, where we will announce our biggest product news of the year.”

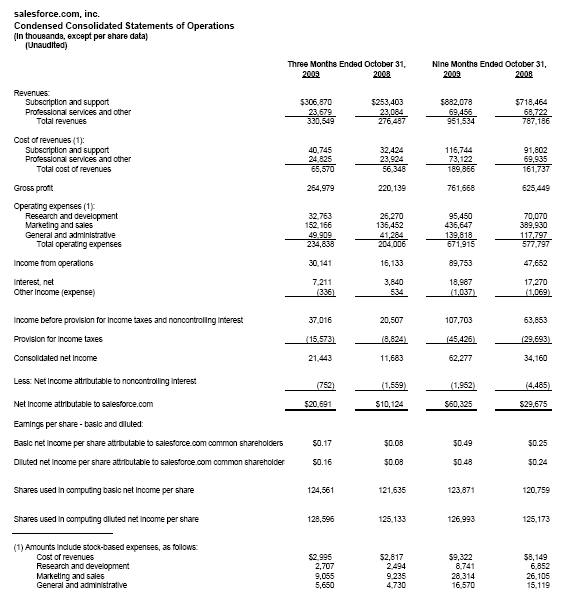

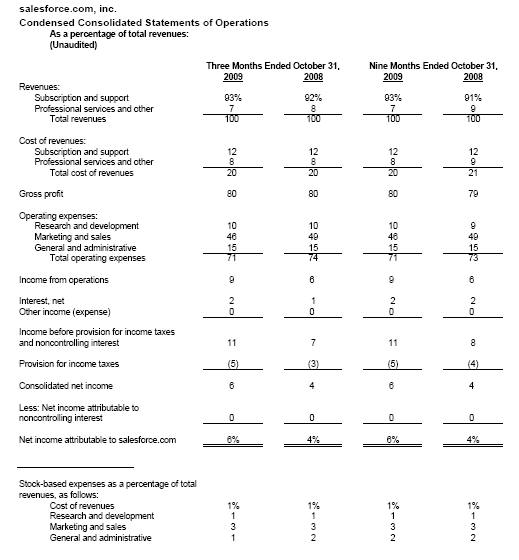

Salesforce.com delivered the following results for its third quarter, fiscal year 2010:

Revenue: Total Q3 revenue was $330.5 million, an increase of 20% on a year-over-year basis. Subscription and support revenues were $306.9 million, an increase of 21% on a year-over-year basis. Professional services and other revenues were $23.7 million, an increase of 3% on a year-over-year basis.

Earnings per Share: Q3 GAAP diluted earnings per share were approximately $0.16, including approximately $20.4 million in stock-based compensation expense and approximately $2.6 million in amortization of purchased intangibles related to previously announced acquisitions. For purposes of the Q3 GAAP EPS calculation, there was an average of approximately 129 million diluted shares outstanding during the quarter.

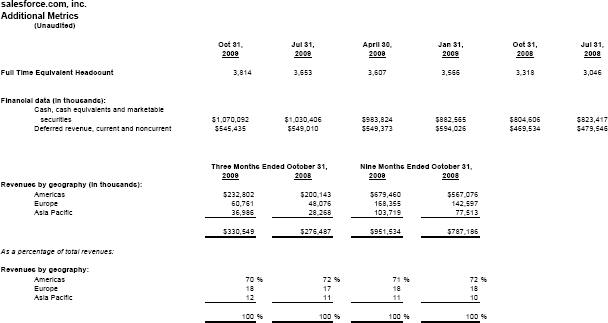

Customers: Net paying customers rose approximately 4,700 during the quarter to finish at approximately 67,900. Compared with the year ago quarter, net paying customers have grown by approximately 16,100 or 31%.

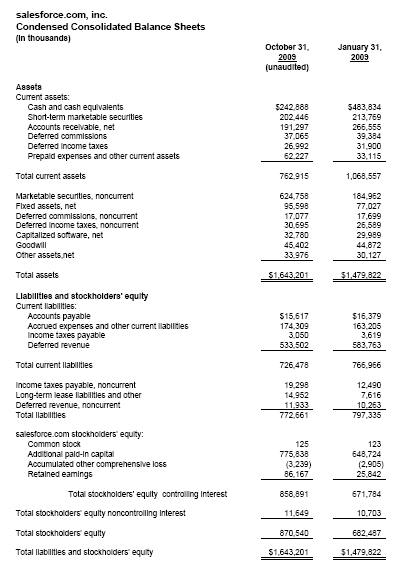

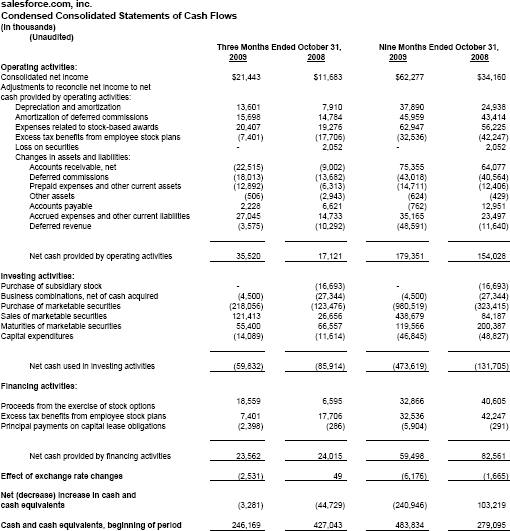

Cash: Cash generated from operations for the fiscal third quarter was approximately $36 million, up approximately 107% year-over-year. Total cash, cash equivalents and marketable securities finished the quarter at approximately $1.07 billion, an increase of approximately $265 million from the year prior.

Deferred Revenue: Deferred revenue on the balance sheet as of October 31, 2009 was $545 million, an increase of 16% on a year-over-year basis.

As of November 17, 2009, salesforce.com is initiating guidance for its fourth quarter, fiscal year 2010. For its full fiscal year 2010, the company is raising its prior revenue and EPS guidance. In addition, the company is initiating revenue guidance for its full fiscal year 2011.

Q4 FY10: Revenue for the company’s fourth fiscal quarter is projected to be in the range of approximately $340 million to approximately $342 million. GAAP diluted EPS is expected to be in the range of approximately $0.14 to approximately $0.15. Stock-based compensation expense is expected to be approximately $26 million, and amortization of purchased intangibles of previously announced acquisitions is expected to be approximately $2.6 million. For purposes of the Q4 GAAP EPS calculation, the company is expecting an average diluted share count of approximately 132 million shares, a GAAP tax rate of approximately 40% and a noncontrolling interest charge of approximately $1.5 million.

Full Year FY10: The company today is raising the full year revenue guidance it provided on August 20, 2009 with revenue now expected to be approximately $1.292 billion to approximately $1.294 billion. The company is also raising its earnings outlook for the full year, expecting GAAP diluted EPS to be in the range of approximately $0.62 to approximately $0.63. Stock-based compensation expense is expected to be approximately $89 million, and amortization of purchased intangibles of previously announced acquisitions is expected to be approximately $9.9 million. For purposes of the full fiscal year 2010 GAAP EPS calculation, the company is expecting an average diluted share count of approximately 127 million shares, a GAAP tax rate of approximately 42%, and a noncontrolling interest charge of approximately $3.5 million.

Full Year FY11: The company is initiating revenue guidance for its full fiscal year 2011 with projected revenue growth in the range of approximately 15% to 16% when compared to projected fiscal year 2010. The company expects to update this guidance, as well as provide its expectations for FY11 GAAP EPS when it announces its fourth quarter, fiscal year 2010 results planned for February, 2010.

About salesforce.com

Salesforce.com is the enterprise cloud computing company. The company's portfolio of Salesforce CRM applications, available at http://www.salesforce.com/products/, has revolutionized the ways that companies collaborate and communicate with their customers across sales, marketing and service. The company's Force.com Platform (http://www.salesforce.com/platform/) enables customers, partners and developers to quickly build powerful business applications to run every part of the enterprise in the

cloud. Based on salesforce.com’s <http://salesforce.com> real-time, multi-tenant architecture, Salesforce CRM and Force.com offer the fastest path to customer success with cloud computing.

As of October 31, 2009, salesforce.com manages customer information for approximately 67,900 customers including Allianz Commercial, Dell, Dow Jones Newswires, Japan Post, Kaiser Permanente, KONE, and SunTrust Banks.

Any unreleased services or features referenced in this or other press releases or public statements are not currently available and may not be delivered on time or at all. Customers who purchase salesforce.com applications should make their purchase decisions based upon features that are currently available. Salesforce.com has headquarters in San Francisco, with offices in Europe and Asia, and trades on the New York Stock Exchange under the ticker symbol "CRM". For more information please visit http://www.salesforce.com.