Chinese cars at the European market gates

Chinese carmakers are gearing up to enter the European market after testing the US waters some time back.

Chinese carmakers are gearing up to enter the European market after testing the US waters some time back.

Though Chinese carmakers have not made much headway in the US due to the strict emission and safety norms, many have managed to make their presence felt in the marketplace and are currently reworking their overseas strategies. The decision to test the European waters is also part of the strategy by Chinese automobile manufacturers to explore new markets.

The European sojourn now looks more promising as the demand economics are changing globally to fuel-efficient and small cars. In the first quarter of 2009 about 3.4 million new cars were sold in Western Europe, 17 percent less than within the same period last year - and the bigger the cars, the bigger the sales drop.

Leading German automobile expert, Ferdinand Dudenhoffer from the University of Duisburg-Essen, said Chinese cars would soon have an important role to play in the European marketplace. "In five years, the Chinese carmakers can become what the Koreans are today," he told China Daily.

"In sunrise industries such as electric and hybrid cars the Chinese automakers will be quicker than their German competitors would imagine," Dudenhoffer said. He said that China would be "the center of the automobile industry" by 2020. "Nothing can stop this country."

Dieter Zetsche, CEO of Mercedes Benz, acknowledges that "China, unlike other economies in the world, is still in the growth mode".

"Cars from China could soon become serious market players in Switzerland," the Swiss automobile club TCS said recently after a crash test for Brilliance BS 4 cars.

Brilliance Jinbei has been one of the first movers in the tough European market. In Germany, Brilliance is the only Chinese brand that has acquired a local distribution certification and started selling its cars.

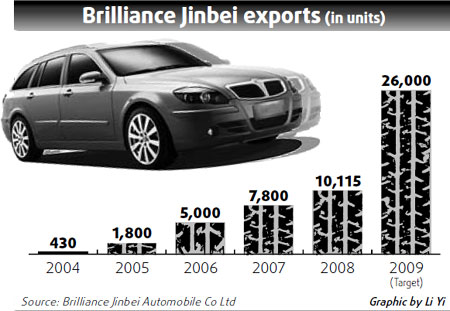

Last year Brilliance Jinbei exported 10,115 vehicles, of which less than 10 percent was to Europe. The major export markets have been Southeast Asia, Africa and Latin America. For 2009, the company is targeting a sales number of 26,000 cars outside China.

Hans-Ulrich Sachs, managing director of HSO Motors Europe, the European general sales agent for Brilliance, expects car sales to touch 3,000 this year, with bulk of the sales in Germany. Sachs is confident that Brilliance will perform well due to its competitive prices and car design. "We are also confident as we score well on safety parameters," he said.

There has, however, been much controversy about the correct evaluation of Brilliance's BS 4 crash test conducted by several European automobile clubs. While the automobile clubs from the Netherlands, Austria and Switzerland credited three out of five stars to BS 4's crash performance, their German counterpart ADAC assigned a crushing zero star.

"Although the BS 4 is considerably safer than the BS 6 two years ago, the European crash norms have been tightened," an ADAC spokesman told China Daily. Car expert Dudenhoffer, said that this evaluation would make it hard for Brilliance to establish its brand in Germany, where car safety is a major selling point.

"It was an unfair crash test for Brilliance. We feel regrets over the ADAC result," said Hao Yongxin, director of overseas sales and marketing with Shenyang Brilliance Jinbei Automobile Co Ltd.

Brilliance importer HSO also expressed its concern on the differing test interpretations. "It is hard to shake off the impression that a card with political dimensions is being played here," HSO said in an official statement in reply to ADAC's zero star press release.

Sachs believes that some European automakers have developed "strong concerns" about Brilliance entering their home market. Ironically for Sachs the present situation is similar to the one he faced 17 years back when introducing Hyundai cars from Korea in Europe. "Like Hyundai back then, now Brilliance is being taken seriously," he said.

While Brilliance is trying its luck in Europe with upper and middle class cars, Dudenhoffer reckons that other Chinese carmakers are more likely to pose a threat to the likes of Volkswagen or Mercedes. He is convinced that the Chinese road to success will be built upon "small, budget-priced cars with reasonable security and quality standards". Dudenhoffer regards Geely or FAW as the more serious contenders in the European market. "Their prospects in the small car segment are quite bright."

Michael Bnning, sales and marketing director of BLG Automobile Logistics, HSO's Brilliance business transportation partner, is convinced that there will also be a niche in the upper class market for Chinese automakers: "We believe in Brilliance and in their future plans of selling cars in Europe." He added that his company and HSO are willing to further collaborate with Chinese automakers to improve the performance in future European crash tests.

The European car market is dominated by Volkswagen (Volkswagen, Audi), with a 2008 market share of 18.8 percent and sales of around 3 million units. PSA (Citroen, Peugeot) from France and US automaker Ford (Ford, Volvo) achieved market shares of 13.5 percent and 10 percent respectively.