Luxury-car dealers go online to dodge Beijing's pricing crackdown

A government campaign in China against the high prices of luxury cars is hitting the profit margins of auto dealers, prompting them to supplement income through the online trading of secondhand vehicles.

SHANGHAI -- A government campaign in China against the high prices of luxury cars is hitting the profit margins of auto dealers, prompting them to supplement income through the online trading of secondhand vehicles.

The strategy is a major shift from relying on showroom sales of luxury cars, a business that had rewarded dealers with profits of as much as 10 percent.

Many dealers had not been involved in the used-car market as they considered the resale margins paltry.

But with new-car prices falling as Beijing's campaign progresses, Jaguar dealer China Yongda Automobiles Services Holdings and at least three peers have set up online marketplaces where they charge vendors for selling used cars, and offer consumers related products and services such as insurance and repairs.

As consumers return to the websites for sundry services, dealers such as Wuxi Commercial Mansion Grand Orient Co. hope they will eventually be tempted to buy one of Wuxi's new Porsches or Cadillacs.

"E-commerce is the trend, and we need to change the way we do business," President Wang Zhen of Baoxin Auto Group, China's top BMW dealer, said in an interview. "There is huge potential in the used-car market."

But the strategy is a double-edged sword. Used-car buyers and sellers could be drawn to the sites because of the dealers' expertise. But the market is largely unregulated so if a transaction goes awry, the dealers risk reputational harm.

"A big hurdle in China's used-car market is the lack of trust," said analyst Wan Dong at Capital Securities. "Without a credible agency that tells you how much a secondhand car is really worth, you don't dare to buy it."

Investigation

Dealers' margins have been under increased pressure since the government this year began investigating whether makers of high-end cars in particular set minimum retail prices for vehicles and parts. The practice can lead to inflated prices and is illegal in China.

The probe prompted Jaguar Land Rover, for instance, to voluntarily lower the prices of three models by an average of 200,000 yuan ($32,600). BMW similarly cut prices for 2,000 parts by 20 percent as an "active response."

Dealers so far look likely to bear the brunt of change. As well as falling prices, gross profit margins of up to 50 percent for aftersales services could also drop as manufacturers will have to share technical information with independent repair shops.

"Dealers' current business model is doomed to go downhill," said analyst Wu Wenzhao of Sinolink Securities. They need to "actively transform."

For Yongda, Wuxi and Baoxin, as well as Audi and Mercedes-Benz dealer Pang Da Automobile Trade Co., playing matchmaker for secondhand car sales could open several channels of revenue.

Simple merchandise

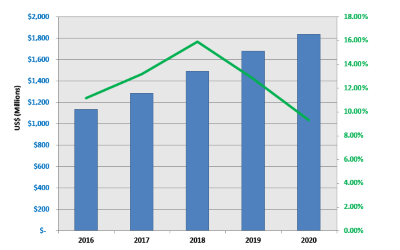

A boom in new-car sales over a decade of double- and near double-digit economic growth has left China's used-car market just a quarter of the size of the new-car market by volume. By comparison, the ratio is opposite in the United States.

With the likelihood of these new-car owners upgrading in coming years, the market for used cars will match that for new cars in 2020, according to the China Association of Automobile Manufacturers.

Individuals already trade used cars on eBay-like marketplaces such as Alibaba Group Holding's Taobao. But dealers say such transactions are risky as consumers often lack the skills to properly evaluate a used car.

"Cars are not the simple merchandise that make up the bulk of what's bought and sold on Taobao," said Wang of Baoxin, which launched autostreets.com last month with partners including Cox Enterprises Inc., owner of U.S. marketplace AutoTrader.com.

In contrast to Taobao, autostreets.com sends staff to evaluate all used cars being put up for sale, and then they put the vehicles on the website.

Ferrari dealer Baoxin owns a fifth of autostreets.com, which aims to eventually capture one-third of the market for secondhand car transactions.

Baoxin also offers financing and insurance through the site, plus maintenance and repairs.

Yongda, which also sells cars from Bentley, is pursuing a similar strategy in partnership with Internet content provider Bitauto Holdings and used car auction site youxinpai.com.

Bitauto and youxinpai.com have separately set up used-car site pdzhixin.cn with Pang Da, and Lexus dealer Wuxi has partnered auction site operator cheyipai.com.

"In the past, new cars were the drivers of growth for dealers," Pang Da chairman Pang Qinghua wrote on the company website. "But now, dealers find it is increasingly difficult to make ends meet by only selling new cars."

But for these ventures to generate significant and sustainable income, tax and regulatory policies governing used-car transactions need to be reformed, said Yale Zhang, head of consultancy Automotive Foresight.

Zhang said, "Used-car transactions are overtaxed and face regulatory challenges so huge that it's tough to make money," even for the middlemen.

The strategy is a major shift from relying on showroom sales of luxury cars, a business that had rewarded dealers with profits of as much as 10 percent.

Many dealers had not been involved in the used-car market as they considered the resale margins paltry.

But with new-car prices falling as Beijing's campaign progresses, Jaguar dealer China Yongda Automobiles Services Holdings and at least three peers have set up online marketplaces where they charge vendors for selling used cars, and offer consumers related products and services such as insurance and repairs.

As consumers return to the websites for sundry services, dealers such as Wuxi Commercial Mansion Grand Orient Co. hope they will eventually be tempted to buy one of Wuxi's new Porsches or Cadillacs.

"E-commerce is the trend, and we need to change the way we do business," President Wang Zhen of Baoxin Auto Group, China's top BMW dealer, said in an interview. "There is huge potential in the used-car market."

But the strategy is a double-edged sword. Used-car buyers and sellers could be drawn to the sites because of the dealers' expertise. But the market is largely unregulated so if a transaction goes awry, the dealers risk reputational harm.

"A big hurdle in China's used-car market is the lack of trust," said analyst Wan Dong at Capital Securities. "Without a credible agency that tells you how much a secondhand car is really worth, you don't dare to buy it."

Investigation

Dealers' margins have been under increased pressure since the government this year began investigating whether makers of high-end cars in particular set minimum retail prices for vehicles and parts. The practice can lead to inflated prices and is illegal in China.

The probe prompted Jaguar Land Rover, for instance, to voluntarily lower the prices of three models by an average of 200,000 yuan ($32,600). BMW similarly cut prices for 2,000 parts by 20 percent as an "active response."

Dealers so far look likely to bear the brunt of change. As well as falling prices, gross profit margins of up to 50 percent for aftersales services could also drop as manufacturers will have to share technical information with independent repair shops.

"Dealers' current business model is doomed to go downhill," said analyst Wu Wenzhao of Sinolink Securities. They need to "actively transform."

For Yongda, Wuxi and Baoxin, as well as Audi and Mercedes-Benz dealer Pang Da Automobile Trade Co., playing matchmaker for secondhand car sales could open several channels of revenue.

Simple merchandise

A boom in new-car sales over a decade of double- and near double-digit economic growth has left China's used-car market just a quarter of the size of the new-car market by volume. By comparison, the ratio is opposite in the United States.

With the likelihood of these new-car owners upgrading in coming years, the market for used cars will match that for new cars in 2020, according to the China Association of Automobile Manufacturers.

Individuals already trade used cars on eBay-like marketplaces such as Alibaba Group Holding's Taobao. But dealers say such transactions are risky as consumers often lack the skills to properly evaluate a used car.

"Cars are not the simple merchandise that make up the bulk of what's bought and sold on Taobao," said Wang of Baoxin, which launched autostreets.com last month with partners including Cox Enterprises Inc., owner of U.S. marketplace AutoTrader.com.

In contrast to Taobao, autostreets.com sends staff to evaluate all used cars being put up for sale, and then they put the vehicles on the website.

Ferrari dealer Baoxin owns a fifth of autostreets.com, which aims to eventually capture one-third of the market for secondhand car transactions.

Baoxin also offers financing and insurance through the site, plus maintenance and repairs.

Yongda, which also sells cars from Bentley, is pursuing a similar strategy in partnership with Internet content provider Bitauto Holdings and used car auction site youxinpai.com.

Bitauto and youxinpai.com have separately set up used-car site pdzhixin.cn with Pang Da, and Lexus dealer Wuxi has partnered auction site operator cheyipai.com.

"In the past, new cars were the drivers of growth for dealers," Pang Da chairman Pang Qinghua wrote on the company website. "But now, dealers find it is increasingly difficult to make ends meet by only selling new cars."

But for these ventures to generate significant and sustainable income, tax and regulatory policies governing used-car transactions need to be reformed, said Yale Zhang, head of consultancy Automotive Foresight.

Zhang said, "Used-car transactions are overtaxed and face regulatory challenges so huge that it's tough to make money," even for the middlemen.