China's IC Market Growth Continues to Outpace Its IC Manufacturing

Future IC production in China is highly dependent on foreign firms like Intel and Samsung.

IC Insights' 2013 edition of The McClean Report - A Complete Analysis and Forecast of the Integrated Circuit Industry contains over 500 pages and 400 tables and graphs has been released and is available for purchase.

China's IC market is forecast to continue growing at a strong rate through 2017 - faster than the growth rate of the worldwide IC market - according to IC Insights' latest forecast contained in the pages of The 2013 McClean Report. The Chinese IC market is forecast to have a 2012-2017 compound annual growth rate (CAGR) of 13%, five points higher than the 8% CAGR forecast for the total IC market during this same timeperiod. China's IC market is expected to reach over $100 billion for the first time in 2014 and almost $150 billion in 2017. In 2017, China is expected to represent 38% of the worldwide IC market (Figure 1), up from 23% ten years earlier in 2007.

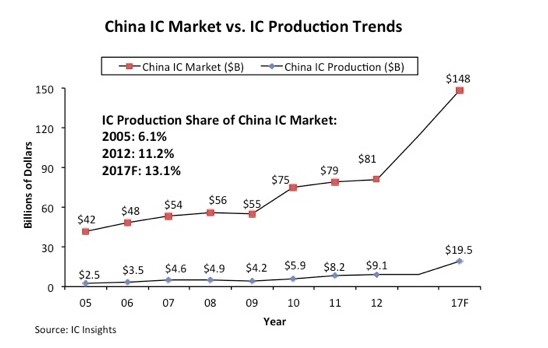

A very clear distinction should be made between the IC market in China and indigenous IC production in China. As IC Insights has oftentimes stated, although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China will immediately, or ever, follow (Figure 2). As shown, IC production in China represented only 11.2% of its $81 billion IC market in 2012. Moreover, IC Insights forecasts that this share will increase only about two points to 13.1% in 2017.

Overall, China-based IC production is forecast to exhibit a very strong 2012-2017 CAGR of 16.5%. However, considering that China-based IC production was only about $9.1 billion in 2012, this growth will come off a relatively small base. If China-based IC production rises to $19.5 billion in 2017, it would represent only about 5% of the total forecasted worldwide IC market of $389.3 billion in 2017.

In 2012, SK Hynix, TSMC, and Intel were the only foreign IC manufacturers that had significant IC production in China. In fact, SK Hynix's China fab had the most capacity of any of its fabs in 2012. Last year, Intel continued to ramp-up its 300mm fab in Dalian, China (it started production in late October 2010), which is expected to give a noticeable boost to the China-based IC production figures over the next few years (the fab currently has an installed capacity of 30,000 300mm wafers per month with a maximum capacity of 52,000 wafers per month).

In early January of 2012, it was reported that Samsung gained approval from the South Korean government to construct a 300mm IC fabrication facility to produce NAND flash memory in in Xian, China. Samsung started construction of the fab in September of 2012 with production set to begin in the first half of 2014. The company expects to invest $2.3 billion in the first phase of the fab with $7.0 billion budgeted in total. This facility is targeting NAND flash production using 10-19nm feature sizes.

Historically, the lack of consistent intellectual property protection has been a major deterrent for foreign firms seeking to establish state-of-the-art IC fabrication facilities in China. In fact, Samsung's 300mm NAND flash memory fab in China in 2014 will be the first IC production fab in the country to incorporate state-of-the-art IC technology!

IC Insights believes that the future size of the IC production base in China is more dependent upon whether foreign companies (e.g., SK Hynix, TSMC, Intel, Samsung, etc.) continue to locate, or re-locate, IC fabrication facilities in China than on the success of indigenous Chinese IC producers (e.g., SMIC, Hua Hong Grace, etc.). As a result, IC Insights forecasts that at least 70% of IC production in China in 2017 will come from foreign companies such as SK Hynix, Intel, TSMC, and Samsung.

China's IC market is forecast to continue growing at a strong rate through 2017 - faster than the growth rate of the worldwide IC market - according to IC Insights' latest forecast contained in the pages of The 2013 McClean Report. The Chinese IC market is forecast to have a 2012-2017 compound annual growth rate (CAGR) of 13%, five points higher than the 8% CAGR forecast for the total IC market during this same timeperiod. China's IC market is expected to reach over $100 billion for the first time in 2014 and almost $150 billion in 2017. In 2017, China is expected to represent 38% of the worldwide IC market (Figure 1), up from 23% ten years earlier in 2007.

A very clear distinction should be made between the IC market in China and indigenous IC production in China. As IC Insights has oftentimes stated, although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China will immediately, or ever, follow (Figure 2). As shown, IC production in China represented only 11.2% of its $81 billion IC market in 2012. Moreover, IC Insights forecasts that this share will increase only about two points to 13.1% in 2017.

Overall, China-based IC production is forecast to exhibit a very strong 2012-2017 CAGR of 16.5%. However, considering that China-based IC production was only about $9.1 billion in 2012, this growth will come off a relatively small base. If China-based IC production rises to $19.5 billion in 2017, it would represent only about 5% of the total forecasted worldwide IC market of $389.3 billion in 2017.

In 2012, SK Hynix, TSMC, and Intel were the only foreign IC manufacturers that had significant IC production in China. In fact, SK Hynix's China fab had the most capacity of any of its fabs in 2012. Last year, Intel continued to ramp-up its 300mm fab in Dalian, China (it started production in late October 2010), which is expected to give a noticeable boost to the China-based IC production figures over the next few years (the fab currently has an installed capacity of 30,000 300mm wafers per month with a maximum capacity of 52,000 wafers per month).

In early January of 2012, it was reported that Samsung gained approval from the South Korean government to construct a 300mm IC fabrication facility to produce NAND flash memory in in Xian, China. Samsung started construction of the fab in September of 2012 with production set to begin in the first half of 2014. The company expects to invest $2.3 billion in the first phase of the fab with $7.0 billion budgeted in total. This facility is targeting NAND flash production using 10-19nm feature sizes.

Historically, the lack of consistent intellectual property protection has been a major deterrent for foreign firms seeking to establish state-of-the-art IC fabrication facilities in China. In fact, Samsung's 300mm NAND flash memory fab in China in 2014 will be the first IC production fab in the country to incorporate state-of-the-art IC technology!

IC Insights believes that the future size of the IC production base in China is more dependent upon whether foreign companies (e.g., SK Hynix, TSMC, Intel, Samsung, etc.) continue to locate, or re-locate, IC fabrication facilities in China than on the success of indigenous Chinese IC producers (e.g., SMIC, Hua Hong Grace, etc.). As a result, IC Insights forecasts that at least 70% of IC production in China in 2017 will come from foreign companies such as SK Hynix, Intel, TSMC, and Samsung.