Fiercely Competitive Tablet Segment Alters 2013 Supply Chain Strategies, According to NPD DisplaySearch

Increased tablet adoption, Apple's strong dominance, and the emergence of new players like Google and Microsoft are changing the competitive landscape in the mobile PC market. As a result, players within the supply chain (display manufacturers, OEMs, and brands) have modified their business strategies and allocation plans to leverage their strengths and maintain market share.

"With the changes taking place in the mobile PC segment, existing supply chain relationships could be disrupted due to competitive conflicts," noted Jeff Lin, Value Chain Analyst at NPD DisplaySearch. "For example, Samsung Display plans to improve its mobile PC customer portfolio by reducing its share in Apple and increasing support to captive brands and other external customers, like Amazon and Barnes & Noble."

Lin added, "In addition, the shift to touch notebooks and ultra-slim devices will be key areas of focus for Apple's mobile PC competitors in 2013. While capturing a larger portion of these market segments will be challenging, competitors will require solid commitments from their supply chain vendors (panel suppliers and OEMs) to ensure capacity and fool-proof, cost-down solutions. For example, HP, Lenovo, Samsung, and Acer have slashed prices on their ultra-slim notebooks in the hopes of combatting the competition."

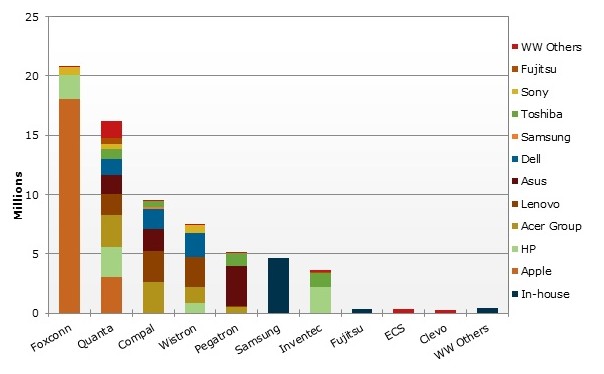

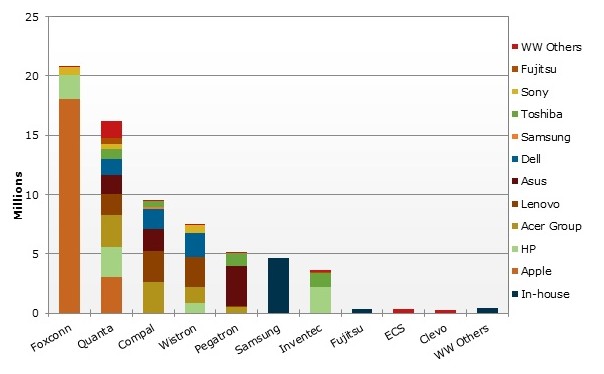

According to the NPD DisplaySearch Quarterly Mobile PC Value Chain Report, LG Display led in mobile PC panel shipments in Q2'12, with more than one-third of its shipments going to Apple. Apple was the clear leader in the mobile PC market, with its tablet PC shipments accounting for 84% of total mobile PC shipments for the quarter, primarily manufactured by Foxconn.

HP ranked second in the mobile PC category, which includes notebooks, tablets, and ultra-slim PCs, with Quanta capturing the largest portion of HP's overall production (about 33%). Foxconn led in mobile PC OEM production volume in Q2'12, with more than 85% of its production volume coming from Apple's new 9.7" iPad and iPad 2. In Q2'12, Quanta started producing the Google 7" Nexus tablet PC.

Figure 1: OEM Shipments to Mobile PC Customers (millions)

Source: NPD DisplaySearch Quarterly Mobile PC Value Chain Report

"With 2013 business planning well underway, product portfolios, sales strategies, and sourcing plans for mobile PC brands will certainly impact the supply chain," Lin added. "Overall, the top 10 PC brands' 2012 Y/Y growth rates are forecast to increase only 2% for notebook PCs and fall 28% for mini-note PCs. However, growth for tablet PCs is still robust at 75%. Looking ahead to 2013, business plans for the top 10 PC brands are set higher, with a 16% Y/Y shipment increase on average for notebook PCs. Tablet PC growth will remain strong, but may be less impressive than in 2012."

The Quarterly Mobile PC Value Chain Report delivers concise, relevant information for decision-makers who need to understand the entire mobile PC supply chain involved in this growing but fast changing and highly competitive market. In addition to an Excel deliverable, a PowerPoint file is provided with enhanced highlights of the most up-to-date information on the value chain. The report also maps the relationships between mobile PC brands, OEMs, and panel suppliers with historical shipments and annual business plans. The product features and development trends for notebook, ultrabook, and tablet PCs serve as bonus information to help decision-makers benchmark against competitors and identify key panel makers and/or OEMs for their supply portfolio.

For more information about the report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452 or e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea, or Taiwan for more information.

Lin added, "In addition, the shift to touch notebooks and ultra-slim devices will be key areas of focus for Apple's mobile PC competitors in 2013. While capturing a larger portion of these market segments will be challenging, competitors will require solid commitments from their supply chain vendors (panel suppliers and OEMs) to ensure capacity and fool-proof, cost-down solutions. For example, HP, Lenovo, Samsung, and Acer have slashed prices on their ultra-slim notebooks in the hopes of combatting the competition."

According to the NPD DisplaySearch Quarterly Mobile PC Value Chain Report, LG Display led in mobile PC panel shipments in Q2'12, with more than one-third of its shipments going to Apple. Apple was the clear leader in the mobile PC market, with its tablet PC shipments accounting for 84% of total mobile PC shipments for the quarter, primarily manufactured by Foxconn.

HP ranked second in the mobile PC category, which includes notebooks, tablets, and ultra-slim PCs, with Quanta capturing the largest portion of HP's overall production (about 33%). Foxconn led in mobile PC OEM production volume in Q2'12, with more than 85% of its production volume coming from Apple's new 9.7" iPad and iPad 2. In Q2'12, Quanta started producing the Google 7" Nexus tablet PC.

Figure 1: OEM Shipments to Mobile PC Customers (millions)

Source: NPD DisplaySearch Quarterly Mobile PC Value Chain Report

"With 2013 business planning well underway, product portfolios, sales strategies, and sourcing plans for mobile PC brands will certainly impact the supply chain," Lin added. "Overall, the top 10 PC brands' 2012 Y/Y growth rates are forecast to increase only 2% for notebook PCs and fall 28% for mini-note PCs. However, growth for tablet PCs is still robust at 75%. Looking ahead to 2013, business plans for the top 10 PC brands are set higher, with a 16% Y/Y shipment increase on average for notebook PCs. Tablet PC growth will remain strong, but may be less impressive than in 2012."

The Quarterly Mobile PC Value Chain Report delivers concise, relevant information for decision-makers who need to understand the entire mobile PC supply chain involved in this growing but fast changing and highly competitive market. In addition to an Excel deliverable, a PowerPoint file is provided with enhanced highlights of the most up-to-date information on the value chain. The report also maps the relationships between mobile PC brands, OEMs, and panel suppliers with historical shipments and annual business plans. The product features and development trends for notebook, ultrabook, and tablet PCs serve as bonus information to help decision-makers benchmark against competitors and identify key panel makers and/or OEMs for their supply portfolio.

For more information about the report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452 or e-mail contact@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea, or Taiwan for more information.