Company profits take hit on lower global demand, cooling property sector

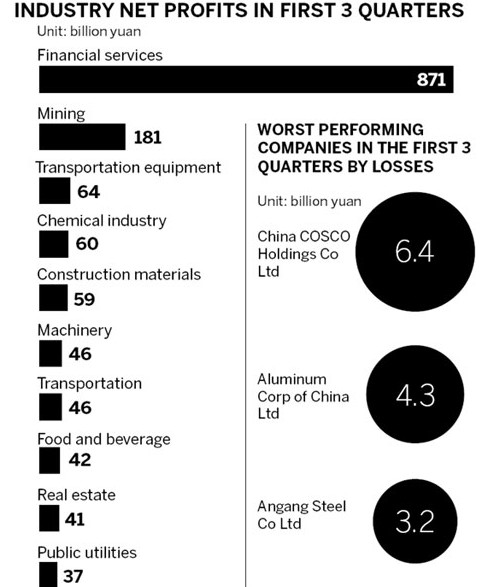

Chinese mainland-listed companies saw a 2.6 percent drop in aggregate net profits in the quarter ended Sept 30 compared to last year, but their combined revenues for the three quarters to date increased 6 percent.

The 2,493 companies listed in Shanghai and Shenzhen posted an aggregate net profit of 476 billion yuan ($76 billion) for the three-month period, a 2.6 percent fall, according to figures provided by Shanghai-based Wind Information Co Ltd.

Combined revenues hit 17.74 trillion yuan in the first three quarters of the year, a 6 percent rise year-on-year, delivering a combined net profit of 1.5 trillion yuan for the nine-month period, only slightly lower than last year's level.

Analysts said the less-than-bullish results reflected the economic slowdown - blamed on dwindling overseas demand and a cooling property market - which has taken its toll on many mainland businesses, especially those in heavy industries such as steel, manufacturing and shipping.

But they added they expect the average corporate performance to improve in the fourth quarter as economic growth recovers.

Zhang Qi, an analyst with Haitong Securities Co Ltd, predicted the struggling stock markets may also enjoy better performances in the fourth quarter, boosted by traditional upticks in consumption around the New Year.

The Shanghai Composite Index lost 0.83 percent in October, closing on Wednesday at 2068.88, while the Shenzhen Component Index lost 2.41 percent in the month, closing at 8369.8.

Peng Wensheng, chief economist of the China International Capital Corp Ltd, said he expects China's GDP to grow by 7.5 percent year-on-year in the fourth quarter.

"China's GDP growth stabilized in the third quarter and will rebound in the fourth," he said.

The Wind Info figures show 423 companies, or 17 percent of the 2,493, reported a loss in the third quarter, and almost half reported a worse performance in the quarter than in the second quarter.

Some companies reported significant losses in the third quarter due to the impact of weakening global demand.

For example, China COSCO Holdings Co Ltd, the country's largest shipping group, made a net loss of 6.4 billion yuan between January and September. In the third quarter alone, the net loss was 1.53 billion yuan.

The group narrowed its quarterly losses as Chinese demand drove a rise in bulk cargo volume and freight rates, and the container shipping market improved.

The group's cash flow was sound, and it attached great importance to improving performance and financial security, according to its report and accounts, with officials outlining plans to make every effort to cut losses and increase profits.

Meanwhile, five major steel companies reported net losses of more than 1 billion yuan in the first three quarters of 2012, as the sector continued to suffer from a prolonged domestic and international drop in demand.

Angang Steel Company Limited reported a net loss of 3.17 billion yuan.

The company's report highlighted that its performance was the result of a slump in steel prices, especially in the third quarter.

It added that despite efforts to reduce costs and improve efficiency, it did not expect the losses to stop in the short term.

The figures also highlighted that companies driven by daily consumption reported high growth in the third quarter, especially liquor producers.

Combined revenues hit 17.74 trillion yuan in the first three quarters of the year, a 6 percent rise year-on-year, delivering a combined net profit of 1.5 trillion yuan for the nine-month period, only slightly lower than last year's level.

Analysts said the less-than-bullish results reflected the economic slowdown - blamed on dwindling overseas demand and a cooling property market - which has taken its toll on many mainland businesses, especially those in heavy industries such as steel, manufacturing and shipping.

But they added they expect the average corporate performance to improve in the fourth quarter as economic growth recovers.

Zhang Qi, an analyst with Haitong Securities Co Ltd, predicted the struggling stock markets may also enjoy better performances in the fourth quarter, boosted by traditional upticks in consumption around the New Year.

The Shanghai Composite Index lost 0.83 percent in October, closing on Wednesday at 2068.88, while the Shenzhen Component Index lost 2.41 percent in the month, closing at 8369.8.

Peng Wensheng, chief economist of the China International Capital Corp Ltd, said he expects China's GDP to grow by 7.5 percent year-on-year in the fourth quarter.

"China's GDP growth stabilized in the third quarter and will rebound in the fourth," he said.

The Wind Info figures show 423 companies, or 17 percent of the 2,493, reported a loss in the third quarter, and almost half reported a worse performance in the quarter than in the second quarter.

Some companies reported significant losses in the third quarter due to the impact of weakening global demand.

For example, China COSCO Holdings Co Ltd, the country's largest shipping group, made a net loss of 6.4 billion yuan between January and September. In the third quarter alone, the net loss was 1.53 billion yuan.

The group narrowed its quarterly losses as Chinese demand drove a rise in bulk cargo volume and freight rates, and the container shipping market improved.

The group's cash flow was sound, and it attached great importance to improving performance and financial security, according to its report and accounts, with officials outlining plans to make every effort to cut losses and increase profits.

Meanwhile, five major steel companies reported net losses of more than 1 billion yuan in the first three quarters of 2012, as the sector continued to suffer from a prolonged domestic and international drop in demand.

Angang Steel Company Limited reported a net loss of 3.17 billion yuan.

The company's report highlighted that its performance was the result of a slump in steel prices, especially in the third quarter.

It added that despite efforts to reduce costs and improve efficiency, it did not expect the losses to stop in the short term.

The figures also highlighted that companies driven by daily consumption reported high growth in the third quarter, especially liquor producers.