Auto industry's slogans no match for R&D

Chinese automakers have relied too much on foreign companies to compete and the gap between domestic and foreign brands threatens to get bigger, industry insiders and analysts said, against a backdrop of a shrinking market and reshuffles in the industry.

Foreign companies helped kickstart China's auto industry, and offered easy success as Chinese automakers earned enormous profits from the sale of foreign-brand cars. But it has also bred complacency, according to analysts.

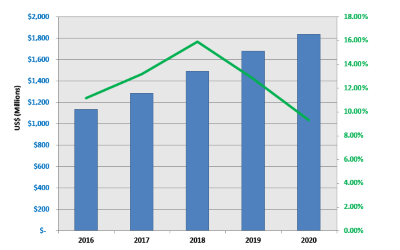

For a time, the problems were masked by glowing statistics, but as the market stutters, the problems have become obvious, said Zhong Shi, an independent auto industry analyst in Beijing.

Auto sales in the country experienced a decade of double-digit growth up to 2011. But those figures were achieved by allowing foreign automakers to build vehicles in joint ventures with local companies, most of them state-owned.

As foreign multinationals took advantage of low labor costs to tap into the world's largest auto market, China hoped that it would attract foreign investment and obtain technology to build up its own auto industry and catch up with the West.

Today, big names such as General Motors, Volkswagen and Toyota are dominant in China. Despite the overall slowdown in the Chinese market, they remain confident about growth and are racing to increase capacity at their joint ventures in the country, where customers prefer foreign-brand cars.

Local brands still lag far behind in terms of both technology and market share. To make matters worse, they are losing out to foreign rivals even in the low-end market. Analysts warned that half of them risk being wiped out sooner or later.

Beware unwanted side effects

Jia Xinguang, another independent analyst, said that while it had benefited from the joint ventures, China had overlooked the "side effects" -- overdependence on ready-made technology and foreign dominance.

Turning a deaf ear to calls to develop their own intellectual property, some state-owned automakers opted for the easy way, relying on their foreign partners for profits while paying lip service to independent research and development, he said.

First Automobile Works Group is an example. Involved in ventures with Volkswagen, Toyota and Mazda, it promised in high-profile publicity to "develop self-owned brands at all costs."

But after a one-year probe, the National Audit Office revealed in June that FAW had not sufficiently invested in independently researching and developing its own models and that its 2008-2010 profits stemmed largely from joint ventures.

The audit report was no surprise for Chinese auto fans. Since the 1990s, a series of FAW vehicles sporting the top Red Flag brand, a communist symbol, have been based on foreign-brand products, including the Audi 100, Lincoln Town Car and Toyota Crown Majesta.

FAW came under the spotlight again this month following an intellectual property dispute with Volkswagen, which is investigating whether its Chinese partner illegally copied its engine designs and plans to export a model equipped with the engines.

"The claim of some state enterprises that they are developing their own models is a marketing stunt intended to show they are listening to state leaders, or else a blatant lie," claimed Jia. "I tell the truth and so they don't like me."

Local brands fail to convince

Criticism has intensified as some state-owned automakers and their joint venture partners launch so-called self-developed local-brand cars. The cars are no more than low-priced, rebadged and relaunched versions of foreign-brand models that just went out of production.

Examples are the Everus S1, which is based on the Guangzhou Honda City, the Venucia D50 based on the Dongfeng Nissan Tiida, or the Ciimo based on the Dongfeng Honda Civic.

Ironically, dealers of the Ciimo in Beijing changed the car's new logo back to Honda's "H" to boost sales because customers prefer foreign brands to real domestic ones, which have a poor reputation for quality.

Though some said that relaunching foreign-brand models as local-brand ones complied with government policy that aims to push foreign companies to transfer technology, many doubted that using old-fashioned foreign technology for "self-developed" cars could provide any long-term benefit.

Without self-owned technology, the Chinese would have to continue depending on foreigners to launch future generations of these cars, they said.

"This is corruption because the policy is made to favor foreign automakers, but not local ones," said Rao Da, chief of the China Passenger Car Association and son of the man who headed FAW in Mao's time. "How come we were able to design and manufacture the luxury Red Flag limousine in the 1950s but needed to import steering technology for mid-sized trucks in the 1980s?"

He believes that using foreign technology wherever possible discourages Chinese technicians from improving and that is why big state-owned automakers have so far failed to stop their own brands losing ground.

Too many joint ventures

Although China's auto industry is widely believed to be overdependent on foreign companies, auto factories continue to sprout across the nation.

Volkswagen and its partner Shanghai Auto are building their seventh plant, Ford said it would build its sixth, and Renault and Nissan's luxury brand Infiniti both said they would begin to produce vehicles here in two years.

Dong Yang, chief of the China Association of Automobile Manufacturers, said "the joint ventures are undeniably successful, but we have attracted enough foreign investment and don't need to open the industry further."

"The government should immediately halt approvals of new joint ventures," Rao warned. "Opening the industry any further will kill off local automakers and even threaten national security."

"It's not joint ventures and huge car sale volumes that will make China's auto industry strong. What we need are domestic companies with strong capabilities in research and development," he added.

Many people are persuaded that the Chinese auto industry followed a strategy of "trading the market for technology," but analysts said it was wishful thinking because core technology can only be acquired by paying high prices or by doing independent research.

"Right now, China is powerless to break away from foreign automakers and their joint ventures. On the other hand, it must promote its own auto industry by taking the tough technology lessons they have so far neglected. That is the only way to stop the dependence deepening," said Zhong.

Wang Xiaoguang, a policy-making advisor at the Chinese Academy of Governance, said that industry policy was fundamentally mistaken and that China should stop state enterprises relying on joint ventures for easy money without doing any real R&D.

"Otherwise, they are doomed to fail," he said.

For a time, the problems were masked by glowing statistics, but as the market stutters, the problems have become obvious, said Zhong Shi, an independent auto industry analyst in Beijing.

Auto sales in the country experienced a decade of double-digit growth up to 2011. But those figures were achieved by allowing foreign automakers to build vehicles in joint ventures with local companies, most of them state-owned.

As foreign multinationals took advantage of low labor costs to tap into the world's largest auto market, China hoped that it would attract foreign investment and obtain technology to build up its own auto industry and catch up with the West.

Today, big names such as General Motors, Volkswagen and Toyota are dominant in China. Despite the overall slowdown in the Chinese market, they remain confident about growth and are racing to increase capacity at their joint ventures in the country, where customers prefer foreign-brand cars.

Local brands still lag far behind in terms of both technology and market share. To make matters worse, they are losing out to foreign rivals even in the low-end market. Analysts warned that half of them risk being wiped out sooner or later.

Beware unwanted side effects

Jia Xinguang, another independent analyst, said that while it had benefited from the joint ventures, China had overlooked the "side effects" -- overdependence on ready-made technology and foreign dominance.

Turning a deaf ear to calls to develop their own intellectual property, some state-owned automakers opted for the easy way, relying on their foreign partners for profits while paying lip service to independent research and development, he said.

First Automobile Works Group is an example. Involved in ventures with Volkswagen, Toyota and Mazda, it promised in high-profile publicity to "develop self-owned brands at all costs."

But after a one-year probe, the National Audit Office revealed in June that FAW had not sufficiently invested in independently researching and developing its own models and that its 2008-2010 profits stemmed largely from joint ventures.

The audit report was no surprise for Chinese auto fans. Since the 1990s, a series of FAW vehicles sporting the top Red Flag brand, a communist symbol, have been based on foreign-brand products, including the Audi 100, Lincoln Town Car and Toyota Crown Majesta.

FAW came under the spotlight again this month following an intellectual property dispute with Volkswagen, which is investigating whether its Chinese partner illegally copied its engine designs and plans to export a model equipped with the engines.

"The claim of some state enterprises that they are developing their own models is a marketing stunt intended to show they are listening to state leaders, or else a blatant lie," claimed Jia. "I tell the truth and so they don't like me."

Local brands fail to convince

Criticism has intensified as some state-owned automakers and their joint venture partners launch so-called self-developed local-brand cars. The cars are no more than low-priced, rebadged and relaunched versions of foreign-brand models that just went out of production.

Examples are the Everus S1, which is based on the Guangzhou Honda City, the Venucia D50 based on the Dongfeng Nissan Tiida, or the Ciimo based on the Dongfeng Honda Civic.

Ironically, dealers of the Ciimo in Beijing changed the car's new logo back to Honda's "H" to boost sales because customers prefer foreign brands to real domestic ones, which have a poor reputation for quality.

Though some said that relaunching foreign-brand models as local-brand ones complied with government policy that aims to push foreign companies to transfer technology, many doubted that using old-fashioned foreign technology for "self-developed" cars could provide any long-term benefit.

Without self-owned technology, the Chinese would have to continue depending on foreigners to launch future generations of these cars, they said.

"This is corruption because the policy is made to favor foreign automakers, but not local ones," said Rao Da, chief of the China Passenger Car Association and son of the man who headed FAW in Mao's time. "How come we were able to design and manufacture the luxury Red Flag limousine in the 1950s but needed to import steering technology for mid-sized trucks in the 1980s?"

He believes that using foreign technology wherever possible discourages Chinese technicians from improving and that is why big state-owned automakers have so far failed to stop their own brands losing ground.

Too many joint ventures

Although China's auto industry is widely believed to be overdependent on foreign companies, auto factories continue to sprout across the nation.

Volkswagen and its partner Shanghai Auto are building their seventh plant, Ford said it would build its sixth, and Renault and Nissan's luxury brand Infiniti both said they would begin to produce vehicles here in two years.

Dong Yang, chief of the China Association of Automobile Manufacturers, said "the joint ventures are undeniably successful, but we have attracted enough foreign investment and don't need to open the industry further."

"The government should immediately halt approvals of new joint ventures," Rao warned. "Opening the industry any further will kill off local automakers and even threaten national security."

"It's not joint ventures and huge car sale volumes that will make China's auto industry strong. What we need are domestic companies with strong capabilities in research and development," he added.

Many people are persuaded that the Chinese auto industry followed a strategy of "trading the market for technology," but analysts said it was wishful thinking because core technology can only be acquired by paying high prices or by doing independent research.

"Right now, China is powerless to break away from foreign automakers and their joint ventures. On the other hand, it must promote its own auto industry by taking the tough technology lessons they have so far neglected. That is the only way to stop the dependence deepening," said Zhong.

Wang Xiaoguang, a policy-making advisor at the Chinese Academy of Governance, said that industry policy was fundamentally mistaken and that China should stop state enterprises relying on joint ventures for easy money without doing any real R&D.

"Otherwise, they are doomed to fail," he said.