Coal industry faces bleak winter

China's coal industry is facing a severe downturn as the national economic slowdown has led to a slump in coal demand and prices.

The Inner Mongolia autonomous region, which benefited from the rapid development of its coal industry in the past few years, is making efforts to help its coal companies cope with this challenging period.

The Inner Mongolia Chamber of Commerce in Beijing on Wednesday launched its energy branch, which is responsible for providing the region's energy companies with a platform to support their development.

Liu Yuchuan, chairman of the branch, said the platform will include a coal port in Caofeidian and an integrated coal trading system.

Up to 80 percent of the member companies in the chamber's energy branch are doing business related to coal production and trading.

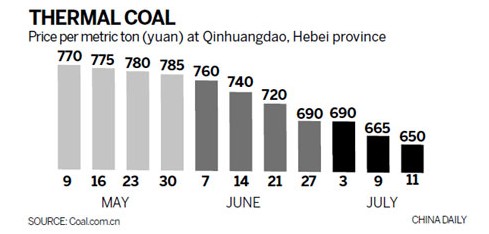

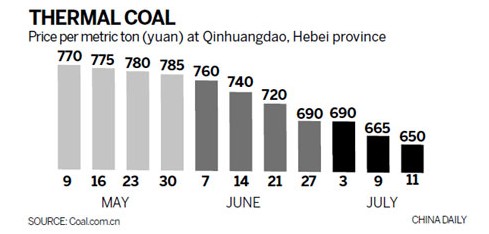

The coal market has been declining since May. Coal prices dropped 20 yuan ($3) per metric ton in June, which has forced many coal producers to stop or reduce production.

"As far as I know, many coal mines in Inner Mongolia have stopped production because of the weak market," said Liu Feng, head of Baotou Zhengxing Material Co Ltd, a trading company specializing in steel and coal.

He said that the reorganization and consolidation of the coal industry was continuing in Inner Mongolia, which had affected private investors' confidence.

"Coal prices are falling dramatically. Private coal companies are suffering. But the State-owned ones are strong enough to cope," he said.

A coal trader, who wished to remain anonymous, from Shanxi province, which meets about 70 percent of the nation's total coal demand, said the current problem is the absence of buyers.

Coal inventories in Qinhuangdao port, the world's largest coal-trading port, hit 9.3 million tons in June and are now around 8.5 million tons.

"I stayed at Qinhuangdao port for two months, and I sold nothing," said the trader. "No one is buying."

Thermal coal prices dropped 160 yuan to 645 yuan a ton at Qinhuangdao port this week compared with 11 weeks ago. Traders have witnessed 11 successive weeks of falling prices so far.

Many small and medium-sized coal mines in Shanxi, Shaanxi and Henan provinces are curtailing their output. However, Shenhua Group Co Ltd, the nation's largest coal producer, doesn't have output reduction plans so far.

Increasing coal inventories, output and shrinking demand led to the rapid price drops in June.

Thermal coal prices reached more than 900 yuan per ton last winter when the National Development and Reform Commission carried out a policy to cap the unit prices below 800 yuan starting from the beginning of this year, in order to control soaring coal prices then.

But after seven months the pressing issue has become how to control falling prices.

There are two thermal coal pricing systems in China. One is market-oriented. The other is agreed through long-term contracts to ensure supply for power companies.

Contracted coal prices are usually 200 yuan lower than market-oriented coal products, and around 1 billion tons of coal are traded under long-term contracts every year.

Some business leaders and analysts said the two pricing systems have affected the normal operation of power companies and coal producers.

Meanwhile, it may lead to corruption when there is shortage in the market.

Xing Lei, a professor at the Institute of China Coal Economy at the Central University of Finance and Economy, said that the government should not intervene in coal pricing, whatever the state of the market.

The Inner Mongolia Chamber of Commerce in Beijing on Wednesday launched its energy branch, which is responsible for providing the region's energy companies with a platform to support their development.

Liu Yuchuan, chairman of the branch, said the platform will include a coal port in Caofeidian and an integrated coal trading system.

Up to 80 percent of the member companies in the chamber's energy branch are doing business related to coal production and trading.

The coal market has been declining since May. Coal prices dropped 20 yuan ($3) per metric ton in June, which has forced many coal producers to stop or reduce production.

"As far as I know, many coal mines in Inner Mongolia have stopped production because of the weak market," said Liu Feng, head of Baotou Zhengxing Material Co Ltd, a trading company specializing in steel and coal.

He said that the reorganization and consolidation of the coal industry was continuing in Inner Mongolia, which had affected private investors' confidence.

"Coal prices are falling dramatically. Private coal companies are suffering. But the State-owned ones are strong enough to cope," he said.

A coal trader, who wished to remain anonymous, from Shanxi province, which meets about 70 percent of the nation's total coal demand, said the current problem is the absence of buyers.

Coal inventories in Qinhuangdao port, the world's largest coal-trading port, hit 9.3 million tons in June and are now around 8.5 million tons.

"I stayed at Qinhuangdao port for two months, and I sold nothing," said the trader. "No one is buying."

Thermal coal prices dropped 160 yuan to 645 yuan a ton at Qinhuangdao port this week compared with 11 weeks ago. Traders have witnessed 11 successive weeks of falling prices so far.

Many small and medium-sized coal mines in Shanxi, Shaanxi and Henan provinces are curtailing their output. However, Shenhua Group Co Ltd, the nation's largest coal producer, doesn't have output reduction plans so far.

Increasing coal inventories, output and shrinking demand led to the rapid price drops in June.

Thermal coal prices reached more than 900 yuan per ton last winter when the National Development and Reform Commission carried out a policy to cap the unit prices below 800 yuan starting from the beginning of this year, in order to control soaring coal prices then.

But after seven months the pressing issue has become how to control falling prices.

There are two thermal coal pricing systems in China. One is market-oriented. The other is agreed through long-term contracts to ensure supply for power companies.

Contracted coal prices are usually 200 yuan lower than market-oriented coal products, and around 1 billion tons of coal are traded under long-term contracts every year.

Some business leaders and analysts said the two pricing systems have affected the normal operation of power companies and coal producers.

Meanwhile, it may lead to corruption when there is shortage in the market.

Xing Lei, a professor at the Institute of China Coal Economy at the Central University of Finance and Economy, said that the government should not intervene in coal pricing, whatever the state of the market.