China to expand high-end equipment sector

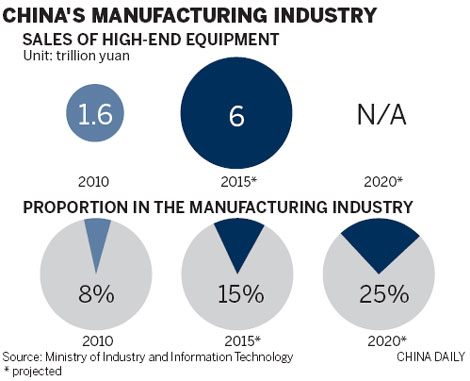

China is looking to triple the sales revenue of its high-end equipment manufacturing industry to 6 trillion yuan ($951 billion) by 2015, according to the sector's 12th Five-Year Plan (2011-15) published on Monday by the Ministry of Industry and Information Technology.

Sales of high-end equipment will account for 15 percent of the overall revenue of the equipment manufacturing industry in three years, compared with 8 percent in 2010, and will also have a larger share of the global market, according to the plan on the ministry's website.

The proportion of revenue is expected to further expand to 25 percent by 2020, when high-end equipment manufacturing becomes a pillar industry of the world's second-largest economy.

In 2010, the sales income of high-end equipment in China was 1.6 trillion yuan.

The boom in the sector was attributed to China's fast-growing industrial economy, which has had the top position worldwide since 2009, according to the plan.

"China's equipment manufacturing industry is big, but not yet strong," said Ren Hongbin, chairman of Sinomach, the country's largest machinery maker.

According to Ren, China's mechanical industry, the main part of the equipment manufacturing industry, is the world's largest, having a main business income of 16.48 trillion yuan in 2011. But the country still faced a total trade deficit of more than $100 billion with Japan and Germany.

"It reflected the huge gap between China and the worlds' leading high-end equipment manufacturers," Ren was quoted by ce.cn, an economic news website, as saying.

The high-end equipment manufacturing industry was named as one of seven "strategic emerging industries" by the country's 12th Five-Year Plan.

The industry mainly includes aviation equipment, satellite and applications, railway transportation equipment, marine engineering equipment, and smart manufacturing equipment.

Aircraft manufacturing will be one of the key growth areas, as the plan vowed to introduce a new regional-aircraft research project, while seeking annual sales of 100 planes in the next three years by accelerating the innovation and promotion of existing models such as the ARJ-21 and MA 60.

Meanwhile, China will continue to invest in high-speed railway innovation and the exploration of global markets to establish its railway transport industry as the world leader.

China's equipment manufacturing industry has been growing at more than 25 percent annually over the past decade. A report by China International Capital Corp said this growth rate will be sustained despite an economic slowdown.

"The key drivers of the development, which are industrialization and urbanization, have not changed," the report said.

CICC's estimate was proved by KHL Group's latest ranking of world's largest construction equipment manufacturers, in which China's Sany Group and Zoomlion Co Ltd are the sixth- and seventh-largest by revenue.

However, it will not be easy for Chinese equipment manufacturers to cash in on the huge demand in the domestic market, Cai Weici, vice-president of the China Machinery Industry Federation, said earlier.

"Foreign high-end equipment providers usually charge high prices for their products, which we cannot make, and cut the price immediately after our products make progress to stifle Chinese brands in the cradle," Cai said.