Steady Adoption of PLM Applications in China

PLM market is expected to grow in the near future. However, it is still a steady progress in china.

PLM is the strategic choice for manufacturing enterprises that seek to maintain their competitive advantage and improve their core product creation competence. PLM, or Product Lifecycle Management, enables companies to manage both the product creation process as well as the data created during the product's lifecycle, whether that is a few months, as in the case of a cell phone, or decades for an airplane. PLM applications have been proven to improve the efficiency of R&D and new product development and enhance collaboration during the R&D process, thereby shortening time to market and cutting product cost.

At the end of 2004, e-Works surveyed 200 Chinese manufacturers in 21 provinces. Figure 1 shows the geographic distribution of these manufacturers and highlights the fact that the majority of manufacturers are located in coastal provinces.

Figure 1: Geographic distribution of surveyed manufacturers

Our research, shown in Figure 2, found that Chinese manufacturers in the automotive, aerospace, consumer electronics, telecommunication production and machinery industries are more likely to use PDM/PLM software applications than those in other industries.

Figure 2: Industrial distribution of PDM/PLM user companies

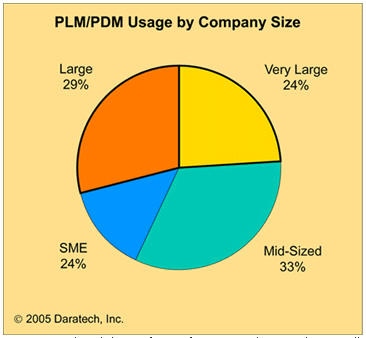

In China, PLM software is still predominantly used in very large (revenue over $500 million) and large (revenue between $100 million and $500 million) manufacturing enterprises, especially when product structures are very complicated, the design processes are time-consuming and the design teams are huge (see Figure 3). For the purposes of this survey, a mid-sized manufacturer in China has revenue of $30 million to $100 million while a small-to-mid-sized company has revenue between $10 million and $30 million.

Figure 3: Revenue breakdown of manufacturers using PDM/PLM applications

Buyers Interested in Managing Data

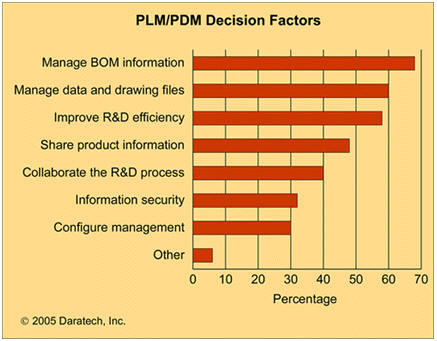

The survey also asked manufacturers to rate their decision factors when choosing a PLM system. As shown in Figure 4, most manufacturers bought PLM systems to manage data: bill of material (BOM), data and drawing files - and to improve the efficiency of their research and development organizations.

Figure 4: PDM/PLM Decision Factors

Chinese manufacturers began to use PDM in 1997, with the introduction of IMAN, then a product of Unigraphics Solutions (now UGS). In 2001, the concept of PLM appeared in the Chinese market, as Teamcenter and Windchill were introduced in China. But even though four years have elapsed since, the application of PLM tools and processes today is still in its infancy, and there are only several thousand PLM deployments in all of China. Furthermore, the majority of PLM implementations are still restricted to a PDM in the research and development organization - not a complete PLM rolled out through R&D, manufacturing, test and the wider enterprise.

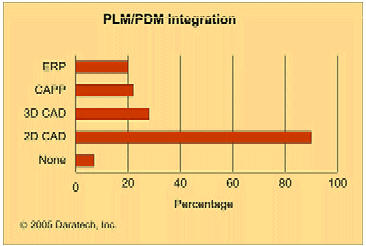

Most PLM customers today use their vendor's work flow management, document management, version control and product structure management applications; very few have deployed the configuration management and change management applications or integrated with ERP and project management applications. Several companies have implemented collaboration tools between design centers located in different places, but implementation of a PLM across departmental boundaries is very rare in China.

In fact, when asked if their PDM and PLM systems were integrated with other design or enterprise systems, most companies report that they are not, as shown in Figure 5.

Figure 5: The integration of PDM/PLM with other application software

Only 50% of Buyers Happy with Overall Implementation

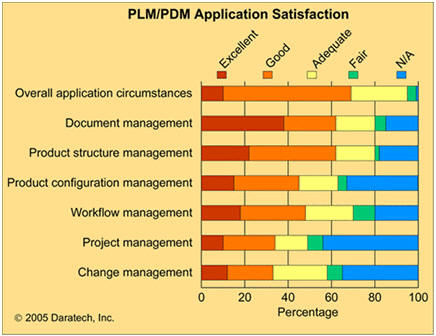

Satisfaction with various elements of the PLM deployments varies widely, as can be seen in Figure 6. The overall application is considered excellent or good by just over half of the respondents; the single highest-rated application is document management, while the lowest-rated applications are project management and change management.

Figure 6: Customer satisfaction with PDM/PLM applications

Market Dynamics

Roughly ten principal domestic PDM vendors serve the Chinese market, in addition to the more widely known international players. Most of the Chinese vendors were initially CAD developers, such as YINGTAI, EXTECH, KMSOFT, TIANYU, CMODES, SIPM, GREATSKY, SKYSHIP and CAXA. Chinese PDM software vendors have made great progress in the last eight years, improving technology, software system architecture, functionality and deployment abilities.

The growth rate of the Chinese PLM market is much higher than the Chinese ERP market, and also much higher than the European and U.S. PLM markets. As a result, the mainstream global PLM vendors are looking to China as a strategic market and are increasing their investments in the region.

PTC, UGS and Dassault Systemes have been in China for a number of years, and have built several successful cases, but there is a great deal of activity as other vendors jockey for position. Agile Software recently opened a subsidiary in China. CIES, a Korean PLM vendor, also opened an office in China and has begun to provide DYNAPDM, their PLM solution, to Chinese manufacturers. MatrixOne also has a distributor in China and, in April 2005, CAXA, the well-known Chinese PLM vendor, in cooperation with Dassault Systemes, announced its CAXA V5 PLM Solutions for the Chinese small and medium enterprise.

There will be intense competition in both the high-end and low-end PLM markets in China in 2005 because the potential and opportunity in the Chinese PLM market is enormous. e-Works and Daratech predict that the growth rate of the Chinese PLM market will be about 30% in 2005.