ERP Market Report Shows Overall Market Growth of 14 Percent in 2004

The midrange ($50M -- $1B in annual revenue) and SMB (less than $50M in annual revenue) markets continue to be a major focus area for many of the ERP vendors. Midrange solutions and channels are critically important for penetrating China, India, Eastern Europe, and Latin America.

AMR Research released its annual report on the state of the Enterprise Resource Planning (ERP) market. The Market Analytix Report: Enterprise Resource Planning, 2004-2009 revealed that ERP market revenues increased 14 percent in 2004. The report indicates that approximately one-third of the growth in the overall market was due to fluctuations in currency exchange rates.

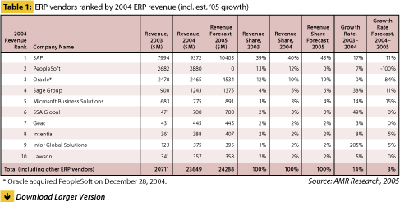

While the ERP market has grown in revenue, consolidation continues to change the industry. In 1999, the top five vendors (J.D. Edwards, Baan, Oracle, PeopleSoft, and SAP) in the ERP market accounted for 59 percent of the industry's revenue. AMR Research expects the top five vendors in 2005 (SAP, Oracle, Sage Group, Microsoft, and SSA Global) to account for 72 percent of ERP vendors' total revenue.

"The ERP market showed solid organic growth in 2004 as IT spending improved," says Jim Shepherd, vice president of research at AMR Research. "The market was also affected by consolidation within the segment, as well as ERP vendors acquiring best-of-breed players to broaden their portfolios."

While many ERP vendors struggled in 2004, SAP AG increased overall revenues by 17 percent and license revenues by 20 percent -- without any acquisitions. SAP's ERP market share increased to more than 40 percent. Oracle nearly doubled the size of its application business through the acquisition of PeopleSoft, but AMR Research expects SAP to finish 2005 with more than twice the revenue and market share of the combined Oracle-PeopleSoft.

The report revealed several trends that affected the ERP market in 2004, including:

- The ERP market is entering another major technology transition phase. Service Oriented Architectures (SOA) may have the same disruptive effect that other technologies have had on the market, such as the emergence of client-server systems had in the 1990's.

- The pace of acquisitions shows no sign of slowing down.? Oracle's purchase of Retek and vendors like Sage Group, SSA Global, Infor Global Solutions, and Epicor have all been very active in the M&A space and have grown more rapidly than the overall ERP market.

- The midrange ($50M -- $1B in annual revenue) and SMB (less than $50M in annual revenue) markets continue to be a major focus area for many of the ERP vendors.? Midrange solutions and channels are critically important for penetrating China, India, Eastern Europe, and Latin America.

- ERP buyers have moved away from large, upfront purchases.? Now most tend to license user seats and functional ERP modules incrementally as they deploy a product.? Along with widespread discounting, this has led to smaller average deal sizes.